Since depreciation expense is tax-deductible, companies generally prefer to maximize depreciation expenses as quickly as they can on their tax filings. Corporations can use a variety of different depreciation methods such as double declining balance and sum-of-years-digits to lower taxes in the early years. In addition, it does not matter if you buy something with your own money or you borrow this money. For this reason, a depreciation tax shield is considered a big advantage to real estate investing. Let’s look at the example of an owner of a fleet of trucks whose equipment depreciated over the tax year.

Examples of Tax Shields

Below, we take a look at an example of how a change in the Depreciation method can have an impact on Cash Flow (and thus Valuation). The dollars saved represent the ‘Tax Shield’ created by Depreciation. As you can see from the above calculation, the Depreciation Tax Savings as the expense increases. In Case we don’t take the Depreciation into account, then the Total Tax to be paid by the company is 1381 Dollar. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

Related AccountingTools Course

When it comes to understanding the tax shield definition, understanding how to calculate it under different scenarios is important. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, these 4 measures indicate that xero DCF, M&A, LBO, Comps and Excel shortcuts. The difference in EBIT amounts to $2 million, entirely attributable to the depreciation expense. There are a variety of deductions that can shield a company (or Individual) from paying Taxes.

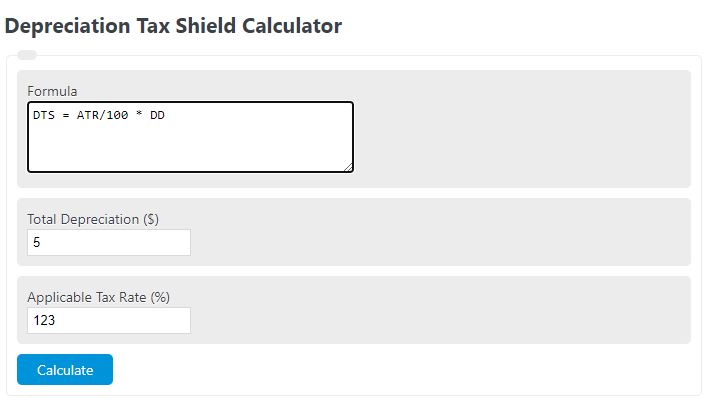

Formula

Tax-efficient investment strategies are cornerstones of investing for high net-worth individuals and corporations, whose annual tax bills can be very high. Taxpayers who wish to benefit from tax shields must itemize their expenses, and itemizing is not always in the best interest of the taxpayer. It only benefits you to itemize when the total of all of your deductions exceeds the standard deduction for your filing status.

How Liam Passed His CPA Exams by Tweaking His Study Process

A depreciation tax shield is a tax reduction technique under which depreciation expenses are subtracted from taxable income. The tax shield is a very important aspect of corporate accounting since it is the amount a company can save on income tax payments by using various deductible expenses. The higher the savings from the tax shield, the higher the company’s cash profit. The extent of tax shield varies from nation to nation, and their benefits also vary based on the overall tax rate. Interest expenses are, as opposed to dividends and capital gains, tax-deductible. These are the tax benefits derived from the creative structuring of a financial arrangement.

The total amount of monthly deductions to the depreciation account is determined on the method best applicable for accounting for the regular wear and tear of a particular asset. Many middle-class homeowners opt to deduct their mortgage expenses, thus shielding some of their income from taxes. On the income statement, depreciation reduces a company’s earning before taxes (EBT) and the total taxes owed for book purposes.

To maximize your depreciation tax shield, it is advisable to consult with a CPA who has experience in our industry. All of these examples enable taxpayers to take deductions on their earnings, which lowers their taxable income and “shields” them from additional taxes. The good news is that calculating a tax shield can be fairly straightforward to do as long as you have the right information. You will need to know your individual tax rate as well as the amount of all your tax-deductible expenses.

The amount by which depreciation shields the taxpayer from income taxes is the applicable tax rate, multiplied by the amount of depreciation. This tax shield can cause a substantial reduction in the amount of taxable income, so many organizations prefer to use accelerated depreciation to accelerate its effect. Accelerated deprecation charges the bulk of an asset’s cost to expense during the first half of its useful life. As the name suggests, tax shields protect taxpayers from paying taxes on their full income.

A tax shield is a way for individual taxpayers and corporations to reduce their taxable income. This happens through claiming allowable deductions like medical expenses, charitable donations, or mortgage interest. Companies using accelerated depreciation methods (higher depreciation in initial years) are able to save more taxes due to higher value of tax shield. A tax shield will allow a taxpayer to reduce their taxable income or defer their income taxes to a time in the future.

It also provides incentives to those interested in purchasing a home by providing a specific tax benefit to the borrower. Implementing an effective tax shield strategy can help increase the total value of a business since it lowers tax liability. Keep reading to learn all about a tax shield, how to calculate it depending on your effective tax rate, and a few examples. Here, we explain the concept along with its formula, how to calculate it, examples, and benefits.

- We note from above that the Tax Shield has a direct impact on the profits as net income will come down if depreciation expense is increasing, resulting in less tax burden.

- A depreciation tax shield is a tax reduction technique under which depreciation expense is subtracted from taxable income.

- Under U.S. GAAP, depreciation reduces the book value of a company’s property, plant, and equipment (PP&E) over its estimated useful life.

- Although it is not an actual expense that you are writing off, it is lowering the income you have to pay taxes on, and, ultimately, you will have less expenses in the end.

- They often do this in one of two ways, either through capital structure optimization or accelerated depreciation methods.

Here we see that depreciation acts as a shield against tax, a cash outflow for the business. Tax shields allow taxpayers to reduce the amount of taxes owed by lowering their taxable income. When filing your taxes, ensure you are taking these deductions so that you can save money when tax season arrives. Taxpayers who have paid more in medical expenses than covered by the standard deduction can choose to itemize in order to gain a larger tax shield. An individual may deduct any amount attributed to medical or dental expenses that exceeds 7.5% of adjusted gross income by filing Schedule A.

Leave a Reply